The 15-Second Trick For Pvm Accounting

The 15-Second Trick For Pvm Accounting

Blog Article

6 Easy Facts About Pvm Accounting Described

Table of ContentsThe 45-Second Trick For Pvm AccountingThe Only Guide for Pvm AccountingThe Facts About Pvm Accounting Uncovered8 Simple Techniques For Pvm AccountingThe 5-Second Trick For Pvm AccountingPvm Accounting for Beginners8 Simple Techniques For Pvm Accounting

In regards to a company's general strategy, the CFO is accountable for leading the business to fulfill financial goals. A few of these strategies might involve the company being obtained or purchases going forward. $133,448 per year or $64.16 per hour. $20m+ in yearly revenue Contractors have developing requirements for workplace supervisors, controllers, accountants and CFOs.

As a business grows, accountants can maximize much more team for various other business tasks. This could eventually result in improved oversight, greater accuracy, and better compliance. With even more resources adhering to the path of money, a professional is a lot more likely to make money precisely and in a timely manner. As a building and construction firm grows, it will require the aid of a permanent monetary personnel that's handled by a controller or a CFO to manage the firm's funds.

Get This Report on Pvm Accounting

While huge services might have full time financial backing groups, small-to-mid-sized businesses can employ part-time accountants, accountants, or economic advisors as needed. Was this post handy? 2 out of 2 people discovered this handy You voted. Change your solution. Yes No.

Effective accounting techniques can make a considerable distinction in the success and growth of building business. By executing these practices, building and construction businesses can enhance their economic security, enhance operations, and make notified decisions.

Detailed price quotes and budget plans are the foundation of building and construction task monitoring. They assist steer the project in the direction of prompt and lucrative conclusion while guarding the rate of interests of all stakeholders included.

The 4-Minute Rule for Pvm Accounting

A precise evaluation of products needed for a project will aid make sure the needed materials are acquired in a prompt way and in the right amount. An error right here can lead to waste or hold-ups as a result of material lack. For most building jobs, tools is required, whether it is purchased or rented out.

Correct equipment estimation will certainly aid see to it the ideal tools is available at the correct time, saving time and money. Don't forget to represent overhead expenditures when approximating task costs. Direct overhead costs are specific to a project and may include temporary rentals, energies, fencing, and water supplies. Indirect overhead costs are daily costs of running your company, such as lease, management incomes, energies, tax obligations, devaluation, and advertising and marketing.

One various other variable that plays into whether a project succeeds is an accurate price quote of when the project will be completed and the related timeline. This price quote assists make sure that a job can be completed within the assigned time and sources. Without it, a task may run out of funds before conclusion, creating prospective work stoppages or desertion.

The Definitive Guide to Pvm Accounting

Exact task setting you back can help you do the following: Understand the earnings (or lack thereof) of each job. As work costing breaks down each input into a job, you can track profitability individually.

By determining these products while the job is being finished, you stay clear of shocks at the end of the task and can address (and hopefully avoid) them in future jobs. One more tool to aid track tasks is a work-in-progress (WIP) timetable. A WIP timetable can be finished monthly, quarterly, semi-annually, or yearly, and includes project data such as contract value, costs incurred to date, complete estimated prices, and complete job payments.

The Pvm Accounting Statements

It additionally provides a clear audit route, which is crucial for financial audits. construction bookkeeping and conformity checks. Budgeting and Projecting Tools Advanced software application uses budgeting and forecasting capacities, enabling building companies to intend future jobs much more accurately and manage their financial resources proactively. Paper Monitoring Building tasks include a great deal of paperwork.

Boosted Vendor and Subcontractor Management The software read review program can track and manage payments to vendors and subcontractors, making certain timely payments and preserving good connections. Tax Obligation Preparation and Filing Accountancy software program can aid in tax prep work and filing, making sure that all pertinent financial activities are precisely reported and tax obligations are filed in a timely manner.

A Biased View of Pvm Accounting

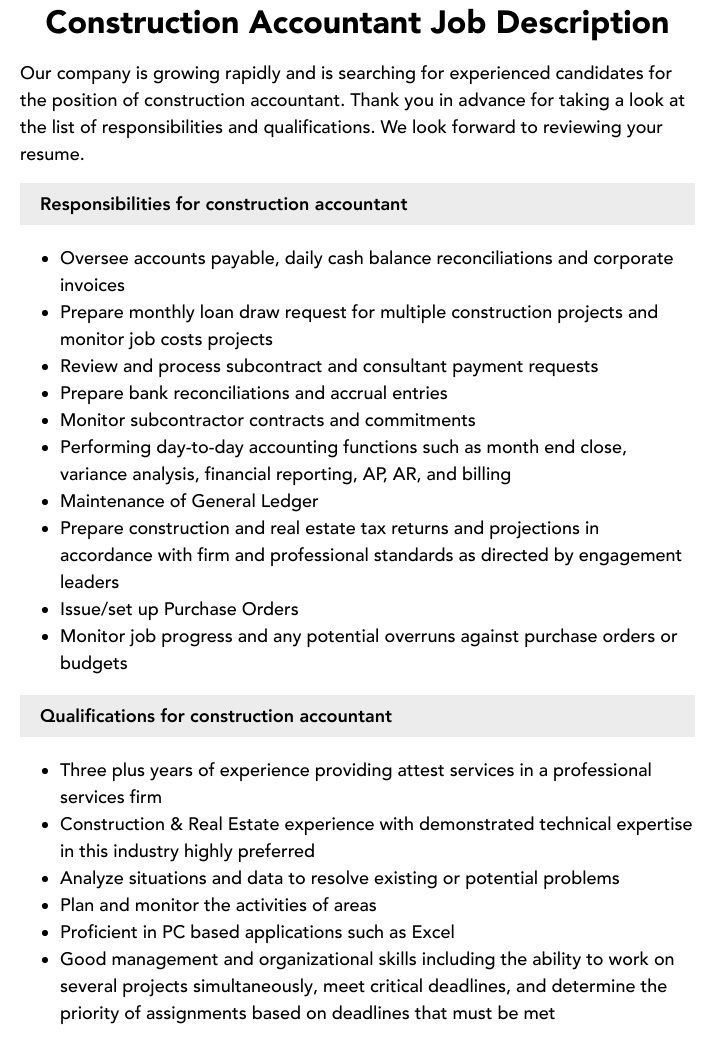

Our customer is a growing growth and building firm with head office in Denver, Colorado. With numerous energetic building and construction tasks in Colorado, we are trying to find an Audit Assistant to join our group. We are seeking a full-time Accountancy Assistant who will be in charge of offering useful support to the Controller.

Get and assess day-to-day invoices, subcontracts, change orders, purchase orders, check requests, and/or other relevant documentation for efficiency and conformity with financial plans, treatments, budget plan, and legal needs. Update month-to-month evaluation and prepares budget plan fad records for building and construction projects.

The 45-Second Trick For Pvm Accounting

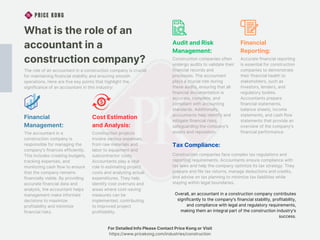

In this overview, we'll look into different aspects of construction accountancy, its significance, the standard tools utilized around, and its role in building jobs - https://pvmaccount1ng.bandcamp.com/album/pvm-accounting. From economic control and price estimating to capital administration, check out just how accountancy can profit construction jobs of all ranges. Building and construction bookkeeping refers to the specialized system and procedures utilized to track economic details and make calculated choices for construction companies

Report this page